|

|

|

|---|

|

|

|

|

|---|

|

|

|

|

|

|

|---|

|

o6sixvp19ym Find Car Insurance Company: A Comprehensive GuideUnderstanding Your Insurance NeedsBefore you start your search, it's important to understand what you need from a car insurance company. Consider factors such as the type of coverage, your budget, and any specific requirements you may have. Types of Coverage

Researching Potential CompaniesResearching car insurance companies is crucial. Look for companies with strong financial ratings, positive customer reviews, and a good reputation in the industry. Online Reviews and RatingsCheck online reviews and ratings from trusted sources. Websites like Consumer Reports and J.D. Power offer insights into customer satisfaction and claims processing. Financial StabilityIt's essential to choose a company with financial stability. Organizations like A.M. Best provide ratings that reflect the financial health of insurance companies. Comparing Quotes and CoverageOnce you have a shortlist of potential companies, compare quotes and coverage options. Keep in mind that the cheapest option isn't always the best. Consider the coverage and services provided for the price.

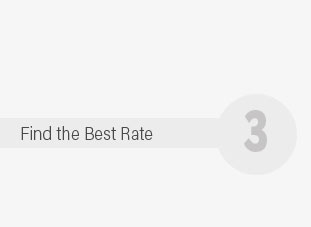

For those looking for specific options, check out car insurance for young drivers, which might offer tailored plans for younger demographics. Making an Informed DecisionOnce you have all the information, it's time to make a decision. Choose the company that offers the best combination of price, coverage, and customer service. Contacting the CompanyBefore finalizing your decision, contact the company directly to ask any last-minute questions and clarify any doubts. Policy DetailsRead through the policy details thoroughly to ensure it meets your needs and that there are no hidden surprises. Frequently Asked QuestionsWhat should I look for in a car insurance company?Look for a company with good customer reviews, strong financial ratings, and comprehensive coverage options that suit your needs. How can I find affordable car insurance in Idaho?To find affordable car insurance in Idaho, compare quotes from multiple insurers, check for discounts, and consider local options like car insurance Idaho for region-specific deals. Why is financial stability important in an insurance company?Financial stability ensures that the company can pay out claims even in challenging times, providing you with reliable protection. https://www.geico.com/auto-insurance/

It's that easy. cheerful young lady working on her computer to find cheap car insurance with Geico. How to compare car insurance quotes. https://www.progressive.com/auto/

Get a free car insurance quote using AutoQuote Explorer and compare different insurers' prices for the same coverage. Find the best rate and policy for you. https://www.libertymutual.com/vehicle/auto-insurance

Rated "A" (Excellent) financial by A.M. Best Company, we've been helping ...

|

|---|